What the Debate Over Abolishing Property Taxes Is Actually About

A fight over taxes that’s really a fight between generations.

Florida Gov. Ron DeSantis’ recent push to eliminate property taxes has kicked up a debate that’s partly about policy disagreements, but largely reflects a divide between older Americans, who are much more likely to be homeowners, and a younger generation that feels locked out of the housing market.

On one side are the boomers, who are sitting on properties whose values have skyrocketed but are entering their retirement years, when cash flow starts to become squeezed.

On the other hand are millenials and other younger residents, many of whom are priced out of homeownership, but rely on the local services, from schools to fire departments, that property taxes fund.

The Data and Visuals:

1: Boomers control a disproportionate share of U.S. wealth.

Source: Statista

2: A housing report released this month by the National Association of Realtors found the share of first-time home buyers has fallen to a record-low of 21%, while the median age of buyers has risen to 40.

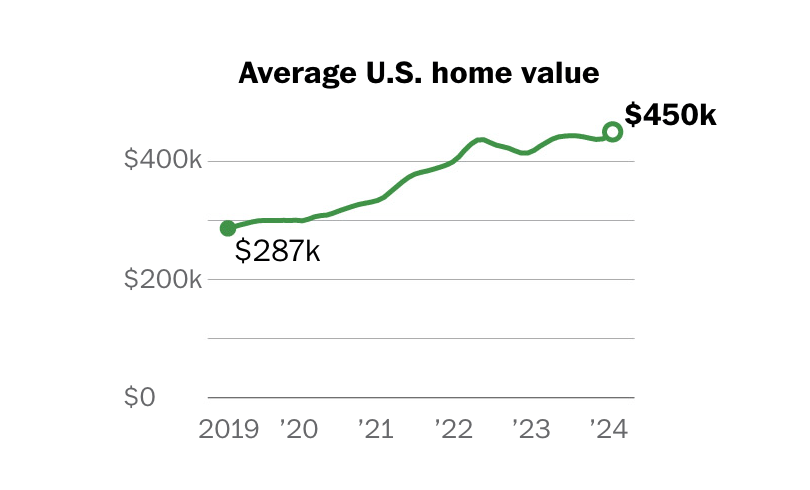

3: The Washington Post’s Kevin Schaul and Rachel Lerman noted last year that, “Since 2019, home prices have surged 54 percent. In the last year, prices increased 5.8 percent.”

4: Property tax revenue funds a solid chunk of government at the state and local level — a combined $630 billion, or roughly 15% of general revenue in 2021, according to the Tax Policy Center.

5: A Realtor.com analysis published earlier this year found older Americans are already getting a good bit of leeway when it comes to property taxes:

16 states + D.C. provide senior exemptions

18 offer tax credits

5 freeze taxes

6 allow deferral until sale or death

The case for abolition:

Those in favor of getting rid of property taxes argue they penalize stability and incentivize housing scarcity.

In DeSantis’ Florida, property taxes have spiked by a whopping 9.5% since 2019.

An ATTOM report published in April found average property tax rates on single-family homes have increased 5.8% across the U.S., with states like New Jersey and Connecticut boasting average tax bills that exceed $8,000.

The case against abolition: Opponents argue that eliminating property taxes would help current homeowners while making entry harder for everyone else.

Studies show higher property-tax rates can encourage older homeowners to sell or move, freeing up homes and improving turnover.

According to the left-of-center Florida Policy Institute, losing the revenue generated by property taxes would require the Sunshine State to double its sales tax to 12%, the highest rate in the nation.

Even libertarians, like Reason’s Christian Britschgi, have expressed skepticism at doing away with Florida’s property taxes, which they view as a comparatively efficient tax.

The online conversation:

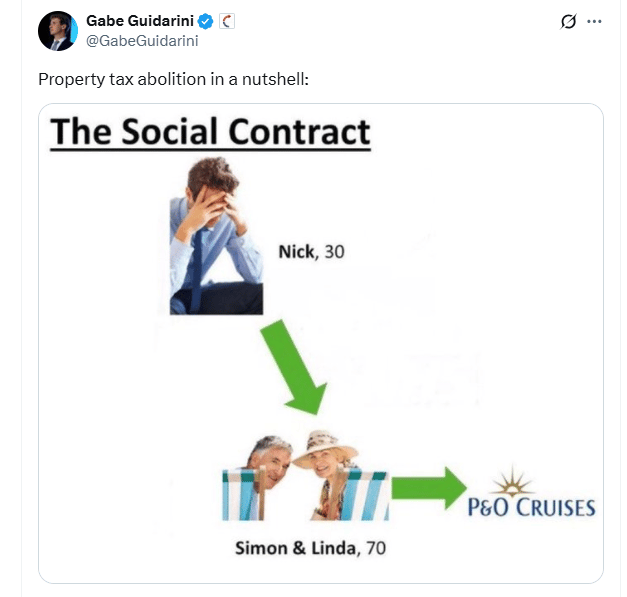

Some Republicans cheered DeSantis’ tax crackdown, but many on the right pushed back. The right has grown much more sympathetic to economic populism (aka policies the GOP would’ve labeled “socialist” a few years ago) since Donald Trump’s rise, and critics framed the plan as a giveaway to already pampered and coddled Boomers.

Bubba’s Two Cents

We’re likely to see more iterations of these generational tensions in the near future, as Gen Z comes into its own as a political force and Boomers decline.

On a macro level, the key piece to all of it is the sense of a widening economic gap: Young people are struggling to find jobs and afford houses. Overall, young and older Americans see their financial futures very differently.